|

今天,小编将给大家带来四大部分!

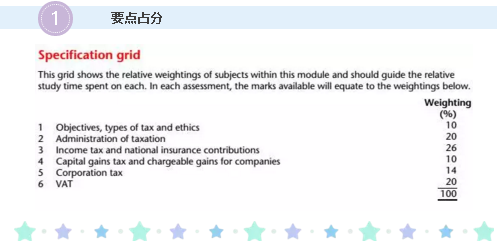

1.PoT考试的要点占分

2.要点所属章节和出题形式

3.难点章节C11.12.13复习要点

4.复习以及考试技巧

一、要点占分

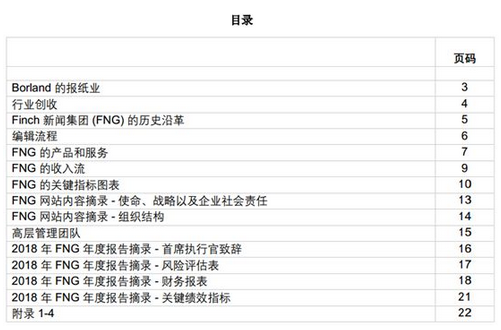

要点所属章节和出题的形式

二、我们更加直观的来看看每个要点的所属章节和考试时可能的出题形式:

其中,大题一共20分,选择与填空题一共80分

要点3占分比最重,但26分包含了6个章节的内容

其次是要点2和要点6,三个章节足足占了40分。可见C11.12.13这三个章节的重要性了。

小编这期将着重为大家梳理一下这两个要点!

三、难点章节复习要点

VAT

VAT部分官网上给出的知识点如下,

VAT主要内容集中在C11&C12。

小编带大家梳理一下这两个章节的内容~

CHAPTER11

2.Classification of supplies

2.1 supplies of goods and services

A supply of goods or services may fall into one of three categories:

Outside the scope of VAT

Exempt supplies

Taxable supplies

You can’t charge VAT on exempt or‘out of scope’items.

2.4 Taxable Supplies应税劳务

Three categories of VAT rates

Standard rate(20%)

Reduced rate(5%)

Zero rate(0%)

Zero-rated means that the goods are still VAT-taxable,but the rate of VAT you must charge your customers is 0%.

3.1 Compulsory Registration

Future prospects test

Hisoric test

4.2 Time of supply(tax point)

特殊规定:

1.The actual tax point cannot be later than the date on which payment is actually received.

2.If a deposit id paid,this creates its own tax point and there will be separate tax point for the deposit and the balancing payment.

3.sale or return basic:

1)adoption by customer

2)dispatch+12months

5.Input VAT进项税

Recoverable VAT条件:

for business purpose+valid VAT invoice

anything that’s only for private use

goods and services your business uses to make VAT-exempt supplies

business entertainment costs

CHAPTER12

1.2 VAT Return

1.功能:

show the amount of VAT payable or recoverable of a VAT registered business.

Submission date:end of VAT period+1个月零7天

Payment date:

Paid electronically:the same as the submission date

Paid by direct debit:due date+3个工作日

The period covered by a VAT return is called VAT period or tax period.Normally the VAT period is a quarter.

2.Small business reliefs

2.1 annual accounting scheme

适用条件:

A biz may join:value of taxable supplies in the following years(excluding VAT and supplies of capital items)≤£1.35m(一百三十五万英镑)

A biz may continue to use:value of taxable supplies in the previous 12 months≤£1.6m(如果超过£1.6m,business must leave the scheme)

Annual accounting scheme

Payment on account方式:

9次+balancing payment(按月)

3次+balancing payment(按季度)

9次+balancing payment(总共10次)

必须paid by electronically。

Payments on account=上一年的VAT liability×10%

或者,若注册VAT小于12个月时:

Payments on account=当年的VAT liability×10%

第一笔金额付款时间是上一个VAT liability结束的第四个月月末。从第一笔付款时间开始,连续在接下来的八个月月末付。

Balancing payment时间是在actual VAT liability结束后的第二个月月末。

3次+balancing payment(总共4次)

必须paid by electronically。

Payments on account=上一年的VAT liability×25%

或者,若注册VAT小于12个月时:

Payments on account=当年的VAT liability×25%

付款时间是会计年度的第4、7、10月月末。

Balancing payment时间是在actual VAT liability结束后的第二个月月末。

2.2 Cash Accounting System

It allows business to account for VAT on the basis of cash paid and received,rather than on invoices received and issued.

There is no deduction for input VAT.

2.3 Flat rate scheme

VAT due=VAT inclusive turnover×flat rate

Notes:

1)VAT inclusive turnover

=taxable supplies+exempt supplies+supplies of capital assets

Administrations of taxation

C13章节占20%的分数,难度和重要性可显而知。

ICAEW官网上关于此章节所给的知识点~

在第13章中,最难的就是那些复杂的规定~相似却不相同!当时也为小编复习时带来不少的苦恼~

下面是小编复习时的法宝~现在分享给大家~

PAYE

IT&CGT

CT

VAT

其他

复习及考试技巧

四、知识点很重要,死记硬背当然是个方法,但是有技巧可以更加合理的复习哦~

小编推荐给大家一些复习方法和考试技巧哦~

1.学会利用官网学习资料。

CFAB阶段的学习资料都可以这样找到哦~

2.分类整理知识点。

3.对比类似知识点。

4.重做错题,加强错题知识点记忆。(很多人认为一味地刷题是最正确的,其实不然,只刷题确不关注错误是无效的。)

5.熟悉Tax table。

6.做题时要做好时间管理。(考试很多时候不是你不会,而是明明会的确没有时间去完成,这就是时间分配不合理,简单、快速的题先完成,需要长时间的题型后完成,掌握做题时间才有更大的机会考试通过。)

7.排除干扰先看题目后读题。(PoT考试很多题目的题干干扰项很多,先读题目可以快速排出干扰项。)

来源:微信号:ICAEW_Students,由中国ACA网【www.aca.cn】综合整理发布,若需引用或转载,请注明来源!

向作者提问

|